Helping students who have financial need.

Need help paying for university?

There are many resources available to help you reduce the cost of attending university.

These include bursaries, students loans, and government programs.

What's the difference between a bursary and a loan?

| type | description |

|---|---|

| Bursaries | A bursary is financial aid intended to supplement, but not replace, your own financial resources. Bursaries don't have to be repaid. |

| Loans and lines of credit |

Available through government or financial institutions, student loans and lines of credit need to be repaid, usually with interest. |

Mount Allison bursaries

Ranging from $1,500 up to $20,000

Get financial support to help pay for university through Mount Allison bursaries!

Bursaries are based on financial need. They are designed to fill the gap between the cost of attending university and your financial resources.

Apply for Mount Allison bursaries in one easy application

- Before you can apply for bursaries, you first have to be offered admission to Mount Allison.

- Then, apply for bursaries in one easy application!

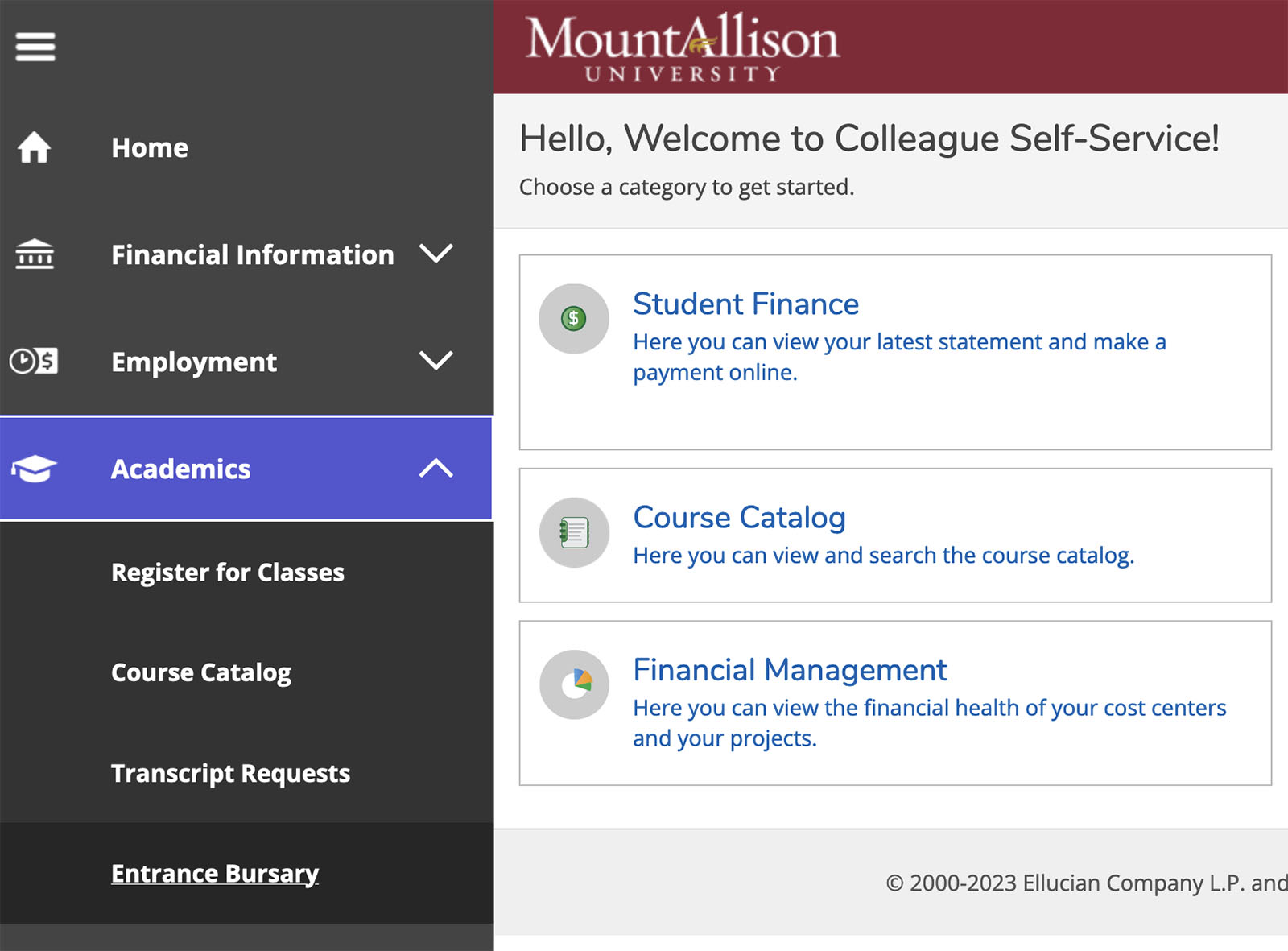

Our bursary application is located in Self Service > Academics > Entrance Bursary. You'll get access to the a secure network once you're admitted to the University.

Details on how to apply for a bursary

Bursary application

Our bursary application is located in your Self Service account — a secure network you'll be able to access once you're admitted.

Once logged in, click on Academics (cap) > Entrance Bursary.

When you apply for bursaries, you will also considered for two types of bursaries:

- entrance bursary

- major bursaries

Information requested on the bursary application

Because bursaries are based on financial need, bursary applications require financial information, including:

- parent(s)/guardian(s) income from previous tax year

- list of financial resources to pay your first year of study

- expand on your student statement ― answer why you need financial assistance; disclose any extenuating circumstances (death, loss of employment, illness, change in family dynamics, or other)

Deadline: to be considered for bursaries, your entrance bursary application must be submitted by March 1.

For applications received after March 1, entrance bursaries will be assessed on a case-by-case basis and are not guaranteed consideration.

Since you have to be admitted to Mount Allison before you can apply for bursaries, we recommend starting your admissions application as soon as possible!

Deadline to apply for bursaries: March 1

*Not available for students starting in January

FAQ

Am I eligible for bursaries?

To be eligible, you must:

- have demonstrated financial need

- be eligible for government student loans

Bursaries (non-repayable) are based on demonstrated financial need and are intended to supplement, but not replace, your own resources and the resources of your immediate family and/or calculated parental contribution as indicated by provincial and/or federal student loans.

Recipients of an entrance bursary must be a recipient of a government student loan in the academic year enrolled. A copy of your student loan assessment will be required.

What is demonstrated financial need?

Cost of attendance minus expected family contributions and financial resources = demonstrated financial need.

Major bursaries

Eligibility for major bursaries vary from financial need, area of study, location, and more.

How will I find out if I got a bursary?

Bursaries are pre-approved on the basis of demonstrated financial need. If you're pre-approved, you will find it listed in your financial aid letter sent by the University in April.

To be fully approved for a bursary, you must be approved for a student loan from your province and/or the Canada Student Loan Program, and send your student loan confirmation to financialaid@mta.ca

How will I receive my bursary?

Bursaries are pre-approved on the basis of demonstrated financial need.

To receive your bursary, you must be approved for a student loan from your province and/or the Canada Student Loan Program.

A copy of your student loan assessment/summary received from the province must be sent to financialaid@mta.ca.

Once we receive your student loan confirmation, your bursary will be applied to your Connect student account.

All students can re-apply for a bursary in their second, third, and fourth year.

For more information, visit receiving your financial aid.

Can I renew my bursary after my first year?

Students must apply for bursaries and student loans each year.

For more information, visit bursaries for current students.

About our bursaries

When you apply for Mount Allison bursaries, you'll be considered for two types of bursaries.

1. Entrance bursaries

Ranging from $1,500-$3,000

All entering students who have demonstrated financial need and are eligible for government student loans can apply for an entrance bursary.

2. Major bursaries

Up to $20,000

Major bursaries offer some of our top valued financial aid. Eligibility for these bursaries vary from financial need, area of study, location, and more.

By submitting your entrance bursary application, you'll automatically be considered for the following major bursaries, should you meet the criteria:

Joyce Foundation Purdy Crawford Bursary — $20,000

| Value |

|

| Eligibility criteria |

|

| Number offered |

|

| Renewable criteria |

|

| Deadline |

|

Samuel and Cora Vallis Bursary — $20,000

| Value |

|

| Eligibility criteria |

|

| Number offered |

|

| Renewable criteria |

|

| Deadline |

|

Oscar Z LeBlanc Bursary— $16,000

| Value |

|

| Eligibility criteria |

|

| Number offered |

|

| Renewable criteria |

|

| Deadline |

|

Harvey Gilmour Bursary — $2,000-$3,000

| Value |

|

| Eligibility criteria |

|

| Number offered |

|

| Renewable criteria |

|

| Deadline |

|

Scoudouc Bursary — $300

| Value |

|

| Eligibility criteria |

|

| Number offered |

|

| Renewable criteria |

|

| Deadline |

|

Student loans and government programs

Loans and grants for Canadian students

All federal, provincial, and territorial governments in Canada offer student loan and grant programs to help offset the costs of post-secondary education.

Am I eligible?

In order to qualify for a federal or provincial student loan and/or grant, you must:

- be a Canadian citizen or permanent resident

- be a resident of the province/territory to which you are applying for funding and have lived there for the past 12 consecutive months (excluding full-time attendance at a post-secondary institution)

- demonstrate financial need

How do I apply?

Available programs can very by province and territory, therefore we strongly encourage you to visit your province of residence website to learn more about their program offerings.

Find out more about government student loans:

- Government of Canada's CanLearn website

- Student loans

Loans for U.S. students

Students with U.S. citizenship or dual citizenship (Canadian and American) may be eligible for loans through the William D. Ford Federal Direct Loan Program.

Students apply for loans using the Free Application for Federal Student Aid (FAFSA). U.S. student loans are processed by our financial aid and awards counsellor.

Questions? We're here to help! E-mail financialaid@mta.ca or call (506) 364-2258.

Financial institution loans and lines of credit

For many students, loans are a useful way to help cover the costs of post-secondary studies.

In addition to government student loan programs private institutions such as banks, trust companies, and credit unions may offer student loan options.

It is important to fully review and understand the terms of your loan, including repayment terms, before borrowing.

What will I need to apply?

When approaching a financial institution for a student line of credit, you will be required to provide a variety of documentation. We suggest your prepare for these meetings or applications by readily having:

- Confirmation of enrollment (request via Connect)

- Estimate of educational costs

- A list of financial resources at your disposal for the upcoming academic year. For example, RESP, savings, scholarships, bursaries, employment, or student loans and grants.

- Proof of Canadian citizenship or landed immigrant

- A co-signer: required for student lines of credit (co-signer is a person obligated to pay back the loan just as you, the borrower, are obligated to pay)

Questions? Our Financial Aid and Awards Counsellor is available to discuss your funding options at financialaid@mta.ca.